About Us

Hala Bou Alwan Legal

Hala Bou Alwan Legal provides tailored legal advisory services, compliance solutions, and specialized training across various industries, with a focus on anti-money laundering (AML), financial crime prevention, cybercrime, governance, ethics, data management, virtual asset licensing, and fintech regulatory matters. We also deliver advanced training programs for compliance officers and industry professionals, including virtual asset compliance training, all CISI-endorsed with CPD hours.

Our mission extends beyond regulatory compliance we are committed to safeguarding businesses and the individuals affected by financial crimes.

Financial crimes, cyber threats, and ethical breaches can have devastating impacts on both organizations and communities. We help businesses integrate compliance, virtual asset risk management, and crime prevention into their core operations, ensuring not only adherence to regulations but also real-world protection. Our customized solutions are designed to mitigate risks and protect your business and those it touches.

At Hala Bou Alwan Legal, compliance is a way of life anchored in the values of integrity, protection, and the promotion of human rights, ensuring that our work strengthens both businesses and the communities they serve.

About The Founder

Hala Bou Alwan is a legal advisor and globally recognized expert in compliance, financial crimes, cybercrimes, human rights, and a prominent media personality. She holds three advanced degrees, including an LLM from Boston University (USA) and a dual LLM from Sagesse University (Lebanon), as well as a JD in law from the Lebanese University Law School, solidifying her expertise in law, compliance, and media.

With over two decades of experience, Hala has worked with governments, regulators, financial institutions, and high-profile organizations across diverse industries, including financial institutions, fintechs, automotive, real estate, academia, gold and precious metals, the public sector, exchanges, virtual assets, and tourism.

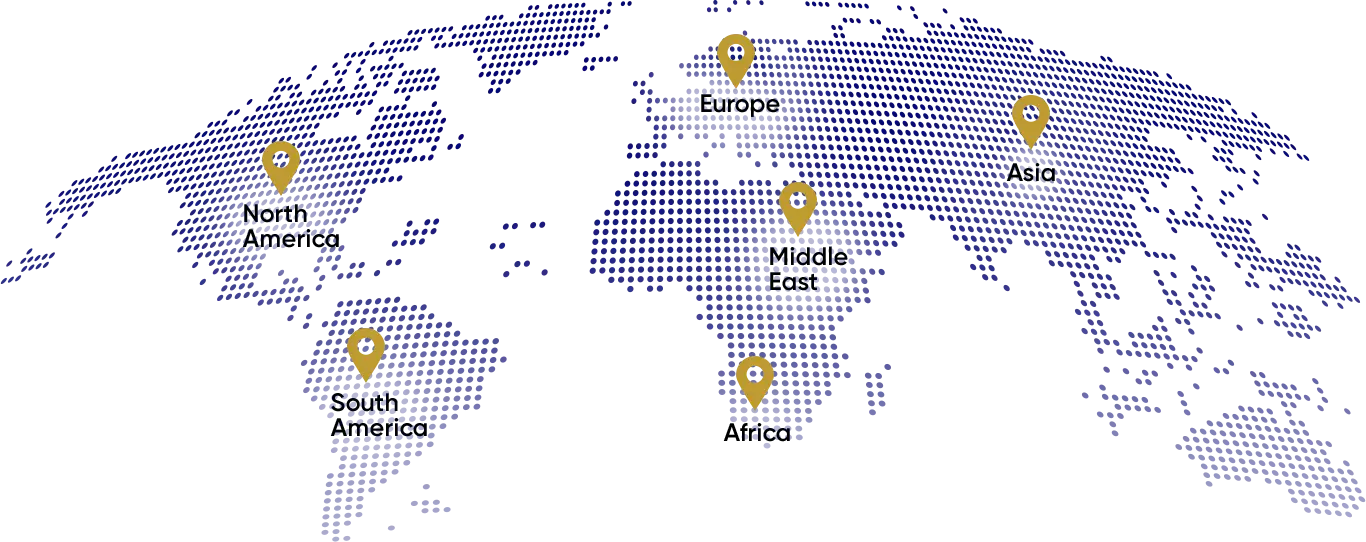

A published author, expert trainer, legal advisor and dynamic public speaker, Hala has written extensively for prestigious journals and universities and is frequently sought after for global events & training workshops. Her work spans across regions including China, Singapore, India, Russia, the USA, Argentina, Brazil, Mexico, Germany, Switzerland, Austria, France, Spain, the UK, Africa, and the Middle East.

Transformative Insights

Legal Advisory and Training Expertise

& AML Advisory

Crimes Advisory

& Dispute Resolution

Services

Management

Compliance Services

Supply Chain Advisory

Compliance & Advisory

Technology Advisory

Investors & Venture Capitals

SDGs Implementation

and Empowerment Advisory

Coaching

& Management

& AML Advisory

Legal advisory on setting up compliance frameworks and AML structures.

Preparation for and response to AML inspections and regulatory audits.

Advisory on the fitness and propriety of teams.

Conducting AML and compliance assessments.

Assistance in detecting and addressing AML red flags and suspicious transactions.

Implementation of FATF recommendations and practical applications.

Crimes Advisory

Specializing in mitigating money laundering, terrorist financing, bribery, corruption, and other crimes.

Providing financial crimes evaluations and assessments.

Helping clients navigate complex regulations, detect red flags, and implement risk mitigation strategies.

& Dispute Resolution

Drafting, reviewing, and negotiating corporate contracts to comply with regulations.

Providing advisory on compliance-related disputes and legal obligations.

Services

Preparing businesses for AML and compliance inspections.

Conducting post-inspection evaluations and offering corrective guidance.

Management

Advisory on ethical business practices and global compliance standards.

Assisting in setting up compliant whistleblowing channels and ethical reporting frameworks.

Ensuring compliance with data protection regulations and handling sensitive information.

Compliance Services

Assistance with obtaining virtual asset licenses and meeting jurisdiction-specific requirements.

Strategic guidance on regulatory obligations, risk management, and best practices in the virtual assets space.

Independent assessments to evaluate compliance readiness and assistance with sourcing qualified compliance professionals.

Advisory on AML/CFT compliance, third-party vendor integration, and ongoing compliance support.

Creation and implementation of compliance frameworks, operational manuals, and internal controls.

Legal opinions on virtual asset operations, regulatory reviews, and company setup in relevant jurisdictions

Supply Chain Advisory

Assess and mitigate risks associated with suppliers, ensuring regulatory compliance.

Ensuring suppliers undergo Know Your Supplier (KYS) checks to minimize risks.

Advisory on creating compliance frameworks to safeguard against financial crimes.

Compliance & Advisory

Advisory on establishing robust CRS and FATCA compliance frameworks.

Providing specialized training and coaching for CRS and FATCA compliance strategies.

Technology Advisory

Identifying vulnerabilities, managing risks, and ensuring cybersecurity compliance.

Addressing legal risks in AI, data breaches, and digital identity.

Investors & Venture Capitals

Conducting compliance due diligence on investment targets.

Helping establish ethical investment frameworks and strong board governance.

Ensuring investors and companies follow KYC and AML procedures.

Providing legal advisory on structuring contracts to ensure compliance.

SDGs Implementation

Assisting businesses in integrating sustainability into operations, aligned with UN SDGs.

and Empowerment Advisory

Advising on fostering a compliance culture through ethical leadership.

Creating an empowered emotional environment promoting ethical leadership.

Coaching

Offering comprehensive training and coaching services to empower businesses and individuals with the latest knowledge and strategies.

Covering topics such as compliance, financial crimes, AML, ethics, data management, leadership, and more.

Providing training in various formats including in-person, 1:1, and public training sessions.

& Management

Specializing in organizing and managing events tailored to specific corporate needs.

Providing customized experiences tailored to enhance learning, promote engagement, and foster strong compliance cultures and team cohesion.

Managing events focused on compliance, governance, financial crimes, CSR, leadership, team bonding, and compliance culture.

Assistance with obtaining virtual asset licenses and meeting jurisdiction-specific requirements.

Advisory on AML/CFT compliance, third-party vendor integration, and ongoing compliance support.

Strategic guidance on regulatory obligations, risk management, and best practices in the virtual assets space.

Creation and implementation of compliance frameworks, operational manuals, and internal controls.

Independent assessments to evaluate compliance readiness and assistance with sourcing qualified compliance professionals.

Legal opinions on virtual asset operations, regulatory reviews, and company setup in relevant jurisdictions

Celebrating Our Wins

One of our most notable achievements was assisting a multinational financial institution in establishing a robust AML framework tailored to their global operations. After conducting a thorough compliance assessment, we provided strategic guidance to detect suspicious transactions, address AML red flags, and meet FATF recommendations. The company passed a stringent audit with flying colors, demonstrating a strong commitment to financial integrity and compliance.

We recently helped a leading fintech company mitigate complex financial crime risks, including money laundering and AI-related fraud. Our team conducted a detailed evaluation of their onboarding processes and transaction monitoring systems, identifying key vulnerabilities. By implementing tailored risk mitigation strategies, the company not only improved its compliance standing but also enhanced its ability to detect and prevent financial crimes effectively.

We successfully guided a regional real estate company through a comprehensive AML and compliance inspection. We ensured the client was fully prepared by conducting a pre-inspection evaluation, identifying gaps, and ensuring all necessary documentation aligned with some AML and compliance laws. After the inspection, our corrective action plan addressed minor findings, enabling the company to maintain compliance and continue operations smoothly.

A major financial institution approached us after being penalized by the regulator. Upon conducting a thorough evaluation, it was discovered that the root cause was not suspicious transactions, but rather issues with data quality, data management, and data updates, which led to failures in their compliance processes. We implemented corrective measures to address these issues, ultimately leading to the penalty being waived and the company restoring full compliance and operational efficiency.

We recently collaborated with a multinational automotive manufacturer to assess the risks associated with its suppliers across several continents. By conducting rigorous Know Your Supplier (KYS) checks, we ensured that all suppliers adhered to legal and regulatory standards. The result was a secure and compliant supply chain that not only mitigated financial crime risks but also improved the company’s operational efficiency and market credibility.

We assisted a global financial institution in setting up an effective framework for FATCA and CRS compliance, ensuring accurate reporting and adherence to international standards. We provided specialized coaching to the institution’s compliance team, enhancing their understanding of regulatory requirements and streamlining their reporting processes. This resulted in a seamless audit and enhanced the company’s reputation for regulatory compliance on a global scale.

We recently helped a tech start-up navigate complex cybercrime and AI regulations. We provided a comprehensive advisory on data security, AI ethics, and digital identity compliance, addressing key vulnerabilities in their systems. The company not only strengthened its cybersecurity defenses but also positioned itself as a leader in ethical AI development, attracting new investment and partnerships.

We played a key role in advising a venture capital firm during its due diligence on a high-profile investment target in the tech industry. We provided guidance on onboarding startups and helped the firm choose whom to invest in, ensuring that the onboarding and selection processes were thoroughly vetted. This approach allowed the investor to mitigate risks and align their investments with sound compliance and regulatory practices.

We were successful in offering training workshops across various industries, focusing on compliance, governance, and financial crime prevention. Our workshops covered essential areas such as money laundering, cybersecurity risks, effective corporate governance, bribery, corruption, and financial crimes, including modern slavery, human trafficking, environmental crimes, and citizenship and residency by investment. We also addressed critical topics like AI and its role in financial crimes, ESG, CSR, FATCA compliance, and ethics in compliance.

Specialized courses were offered on AML for specific sectors such as the gold and precious metals industry, virtual assets, and real estate. Other key areas included managing cyber risks, data governance, sanctions, FATF recommendations, and the integration of sustainability goals in mitigating financial crimes. Participants praised the practical, hands-on approach, which led to immediate improvements in their compliance processes and governance structures.

We were engaged by a major player in the gold and precious metals industry to enhance their AML framework and manage risks related to financial crimes. Our evaluation uncovered areas for improvement in the client’s KYC and transaction monitoring processes. After implementing our recommendations, the company not only reduced its exposure to financial crime risks but also strengthened its relationships with regulators and clients by demonstrating a proactive commitment to compliance.

We were brought in by a bank to evaluate and restructure their compliance department. Through a comprehensive assessment, we identified gaps in team capabilities and governance structures. We not only helped in finding and interviewing the right candidates for critical positions but also repurposed existing team members into roles where they could excel. This restructuring improved department efficiency, fostered stronger governance practices, and enhanced overall compliance within the bank.

We recently assisted a global manufacturing company in reviewing its supply chain and third-party partnerships to ensure compliance with regulations against child labor, forced labor, and modern slavery. By conducting a thorough risk assessment and implementing rigorous due diligence procedures, we helped the company ensure that its operations and partnerships align with ethical labor practices. Our efforts not only safeguarded the company’s reputation but also ensured its full compliance with international labor laws, reflecting its commitment to human rights and responsible business practices.

We successfully provided specialized coaching and 1:1 sessions to professionals managing compliance and financial crimes departments. This involved working with newly hired individuals as well as those advancing into leadership roles, equipping them with the skills to handle team management, strategic decision-making, and the complexities of financial crime prevention. Our coaching enabled future leaders to step into their roles with confidence, build efficient teams, and drive compliance success within their organizations.

Clientele & Global Exposure

At Hala Bou Alwan Legal, we serve a wide range of clients, including global and local financial institutions, multinational corporations, government bodies, and regulatory authorities. Our clientele spans across sectors such as governments, authorities, financial institutions, academia, sustainability, banking, exchanges, gold and precious metals, law firms, company service providers, real estate, virtual assets and VASPs, media, automotive, technology, venture capitalists (VCs), the health sector, and fast-moving consumer goods (FMCGs).

Submit Your Question

for Expert Legal

Guidance

- Main Office- Hala Bou Alwan Legal, Spaces, 1st Floor, Block 2, Dubai CommerCity, 11 17 Street, Umm Ramool, Dubai, United Arab Emirates

- production@hba-legal.com

- +971 55 263 4644

Hala Bou Alwan © All rights reserved.

We maintain adherence and are complaint to the Code of Ethics and Conduct, Anti-Money Laundering Policy, Cyber Security Policies and Terms and to the laws of the United Arab Emirates and all international standards and regulations.